Asset Allocation

A simple strategy to diversify your investment portfolio and reduce the risks.

The most important key to successful investing can be summed up in just two words - “Asset Allocation”. - Michael LeBoeuf (American business author)

In this post we will see the different types of financial assets, it’s properties, pros and cons and try to deep-dive into the allocation strategies for investors with different investing style and risk taking abilities.

Have you ever heard of this proverb emphasizing to always diversify to protect from the risk of losing?

In the finance world, asset allocation is the most important and the primary skill that you would want to master on in order to be a successful investor. It will not only protect you from risk of losing your money but also gives you a nice balance of returns based on your expectations, goals and risk profile.

What is an Asset Allocation?

Asset allocation is a investment strategy to allocate your money in to multiple asset classes, such as cash, equity, bank deposits, gold and real-estates. The purpose of allocating the money going into different asset classes is to ensure that your portfolio performs well under different market and economic conditions and most importantly protecting you from the risk of loosing money during adverse situations.

Why is an asset allocation so important?

Imagine you have put all your money in a land (real-estate) and suddenly there's government project going to take over your land by compensating with only the book value of the land which might be much lower than a market value.

Or imagine you have put all your money in a bank account and due to unforeseen economic condition the bank goes bankrupt and your money is locked from withdrawals.

These all are some adverse situations which might or might not happen, however as it's your hard-earned money it's your responsibility to protect it from such situations.

Does the asset allocation helps only from loosing your money?

Not at all! Asset allocation will also enable to get expected returns from your overall investment portfolio by wisely balancing your risk that you're willing to take.

Remember the quote in earlier newsletter " Where there is a high returns, there is also a high risk"

So, can you put all your money in direct stocks which yield far superior returns compared to any other asset class?

No - because the risk of loosing your capital is also high. This where a proper asset allocation can help to identify what is the right portion of your money going into Stocks, Mutual funds, Bonds, Bank fixed deposits, Savings account, Gold, Real-estate, etc.

Does the asset allocation a one-time activity?

Nope. It is very much recommended to review the net worth of any individual (or) family from time-to-time and one should do appropriate actions to ensure the goal of asset allocation is on track. The period could be quarterly, half-yearly, yearly or even dynamic depends on market conditions and a possible change in diversification styles.

E.g. Assume you have invested 50% of your total money into equities and due to extraordinary market performances in last one year this 50% grows to 65% of your total portfolio and increased the overall risk level, so you could probably take out some money from it and move it to a bond/ debt instrument. This is called Rebalancing in a portfolio management.

So what are the different asset classes that I should explore?

Well there are so many asset classes in financial world (as explained in first newsletter), I feel the below are some really good, easy to understand and common ones that anyone can take advantage of. These products almost cover everyone's purpose as it has lot of methods and sub-types with which you can even frame your own tailor-made asset allocation strategies.

Cash, Savings accounts & Liquid Funds

Fixed Income products (FD, RD, Bonds, Post office schemes)

Real-Estate

Equity (Mutual Funds & Stocks)

Gold

Now lets look at the important properties of each of these asset classes that one should evaluate against there preferences before taking an investment decisions.

Availability: How accessible a financial instrument is to yourself. How quickly you can understand the nitty-gritty of same and start to pouring your money.

Tenure: Does the asset class best suits for short-mid-long term goals.

Liquidity: How quickly can you sell the asset and get money in hand in case of emergency situations.

Return potential: How much average % of returns can we sensibly expect from the asset.

Risk: Chances of loosing your invested capital during adverse conditions.

Here is my opinion of all common asset clauses against each of those properties (Of course I may be biased here and each one of you have different opinion on it, but this is just for a reference).

*Depends on the area & scope of the property.

We now understood the different asset classes and it's properties. Lets see how much money can we allocate to invest in each of these asset classes for different persons with different risk taking level. We will group investors into 5 buckets based on their risk taking abilities.

Important note: The above allocation is only for your reference to start thinking about asset allocation. There are many other parameters and personal preferences that will determine your asset allocation style, so take it with a lot of pinch of salt!

What you saw above is just a basic primer based on a person’s risk profile, however if you want to go further on this, there are various style of asset allocations and you can always get tons of YouTube videos and articles on this very same topic.

Some quick glimpse of widely used styles are

Age Based Asset Allocation: This is very famous in the investing world that you can use “100-Age rule” to make asset allocation decisions. E.g. If you’re 40 years old you can possibly have 60% in riskier asset clauses like Equities and as you gets older you need to reduce the exposure from riskier ones to conservative ones.

Goal Based Asset Allocation: You could also diversify your investments based on your goals that enforces you to achieve certain returns in certain period. One example is given at the end of this thread.

Risk Profile based Asset Allocation: This is the one that I really suggest to every common investor and it’s what you saw in the earlier tabular column example. Here you will need to assess your net worth, family, dependents, etc to derive a risk profile based on which the diversification can be made.

Core & Satellite Portfolio Method: This method is nothing but constructing a strong core portfolio based on any of the above method (mostly with conservative style) and a satellite portfolio with relatively smaller size and riskier assets. It’s a common practice by many investors to use this style with-in the equity portfolio, however I recommend this only after achieving a sizable core portfolio.

Dynamic (or) Rule Based Asset Allocation: This method is following a allocation methodology based on the prevailing market, economic conditions & valuations of the asset clauses. E.g. One could write a rule to allocate more money in equity if the valuations are attractive and route more into Debt instruments if equity valuations exceeds certain threshold. The Hybrid funds or balanced advantage mutual funds follow this methodology and becoming very popular in recent times.

Alright, Alright.. This will be a never ending ocean if you dive deep into each of the methodology but to cut the long story short, here is what I suggest to start with:

Identify your goals & risk taking abilities--> Get a meaningful return expectations from your overall portfolio--> Do asset allocation accordingly by following your preferred method

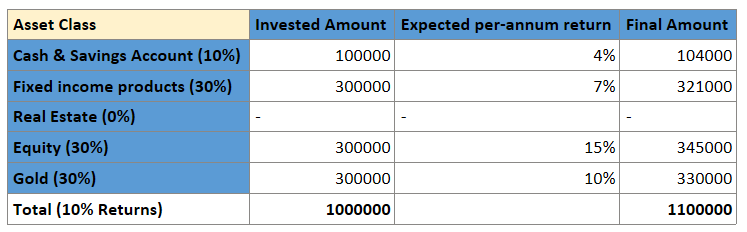

A very quick example for goal based strategy: Lets say I have 10 lakhs to invest, I'm a moderately risk taking person and I expect 10% overall average returns from my portfolio every year. So I could derive a plan something like below.

So, the message from this thread is that please start tracking all your investments and look at your current asset diversification to assess if it’s matching with your expectations and risk appetite. If not, start thinking about fine-tuning it!

I hope you've found something useful in this newsletter and I will see you very soon!

Thank You!!

Stay tuned for my future newsletters to read on topics like mutual funds, direct stock investment strategies, Macro-economic based investments, company case studies, and much more.

Please consider subscribing to my newsletters if you see it useful, also feel free to share it within your circles to those who have similar interests. Thanks!